Coronavirus News

The pandemic isn’t over, but normal feels a lot closer than it did for a long time!

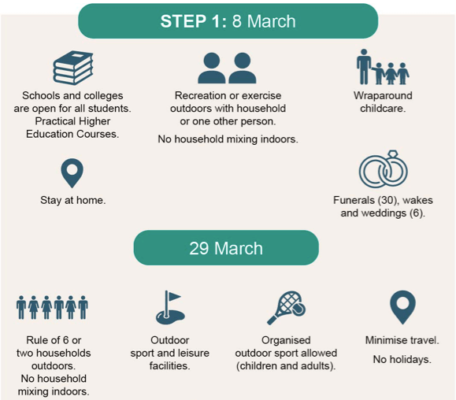

Most Coronavirus restrictions are now lifted, or are a matter of choice, and most support opportunities have drawn to a close. Despite that, we know that many businesses are still fighting the effects of repeated Lockdowns, and we’re here to help those clients get back on track as quickly as possible.

If you’d like to speak to us about any of these announcements, the impact of lock-down on your business, or any other matters, please get in touch.

If you’d benefit from some additional support, please don’t struggle alone.

Remember we’re here, whenever you need us and will be as flexible as we can to help you, whatever that need may look like!

How can we help?

- Construction or amendment of existing Budgets to predict what your business targets need to be over the coming weeks and months.

- Supporting documentation and figures for finance applications.

- Advice, translation and guidance around the various support measures that remain, and how they may apply to your unique business.

- Visit our ‘Rebound Resources‘ page to find the latest videos and downloads to help your business look forwards towards recovery. Review your processes and procedures to make the very most of your hard work, and increasing demand.

Throughout the pandemic we provided hundreds of hours of additional support to our clients without any extra charges, and will continue to do so, so please get in touch if you need us.

Each of our clients receives regular updates that keep them aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just click on the link below and fill in the form and we’ll drop them into your inbox.

The volume of Coronavirus related posts will (we hope!) continue to drop off as cases reduce and we move through the recovery process, but you can catch up on all of our Coronavirus Blog Posts below.

Can I just say we are so pleased that we have moved to Baranov Associates. As we discussed when you visited, we had to find a way to take the stress out of all of the financials and you’re doing that for us! We can see how to use Xero more efficiently and so with us being as on top of it as we can be and with you and Liz we feel a lot more confident about our business being in good shape.

Mrs S James, Sandbanks Capital Partners Limited

Get in touch

"*" indicates required fields