All of these changes will have impacted your Breakeven Point.

Watch this first!

In this video we’re taking you through the process of working out what your new Breakeven is AND giving you a tool to make it easy!

As with all of our Rebound Resources, it’s designed to help your business rebound as quickly as possible!

(Filmed during the first Lockdown, this content is just as relevant to any business facing increasing inflation, staff shortages or increases in wage costs.)

As we emerge from lockdown it’s vitally important that business owners are aware of their new Breakeven figure and our Breakeven Calculator will help you work that out.

Many of the changes and challenges that business owners have faced over the last eighteen months will remain in some form during 2022. Knowing your new Breakeven figure will help you sleep better at night as it’s your baseline requirement for sales.

Having talked about Budgets in an earlier module, Breakeven is effectively your lower limit.

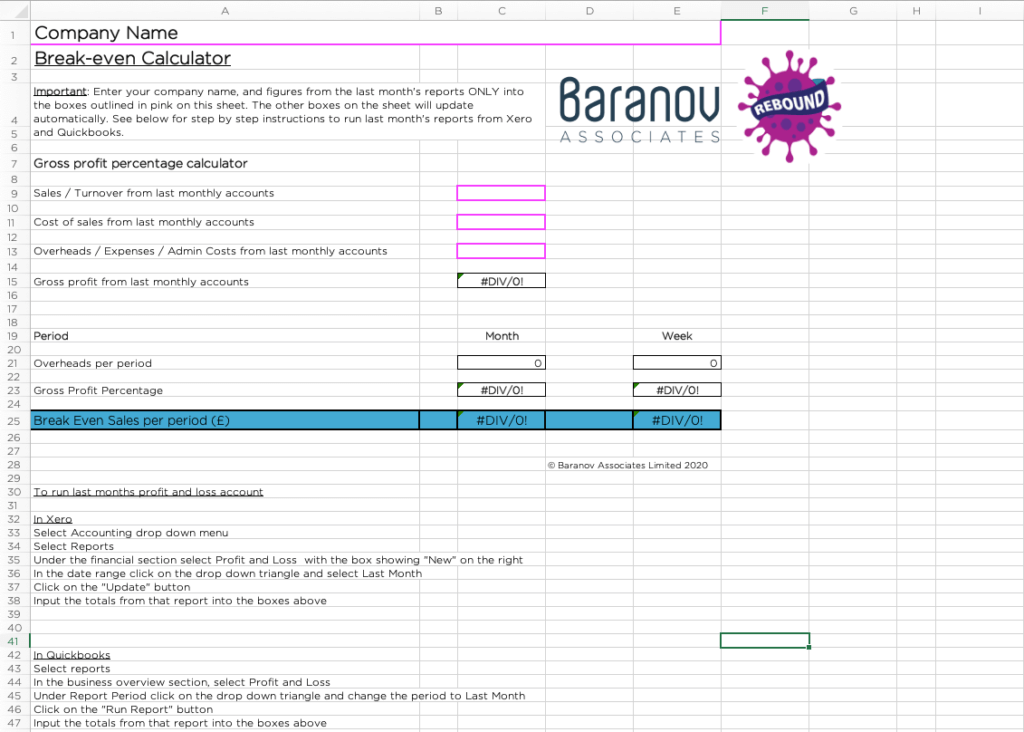

Here’s a picture of our Breakeven Calculator:

As mentioned in the video, this is a spreadsheet where you just need to add 3 numbers shown by the pink boxes and the formulas in the spreadsheet will do the rest for you!

You can download a copy of the Breakeven Calculator here.

At the bottom of the Calculator there are instructions as to how to find the reports that you’ll need for both Xero and QuickBooks.

When you run the reports all you need to do is pick up those three numbers and add them into the spreadsheet. The Calculator will then give you the Breakeven value in pounds. You’ll then need to divide that by the price of your service, your product or your average customer value, to workout how many units you then need to sell.

Make sure that you include your minimum requirement for drawings or salary in this these figures (This would be included in the overheads box.) It’s got to be included as you want to reflect the minimum sales you need to make sure the business doesn’t go backwards.

If you wanted to work out what your Breakeven needs to be for you to be able to withdraw more from the business, you can do a second calculation where you increase the overheads figure by the additional amount you would like to draw. This will give you a figure to aim for. It does assume that the overheads and costs remain unchanged, so bear that in mind as you move forwards!

What if last month’s reports won’t give you a true reflection of the business to work with?

For example, if you weren’t trading last month or if not you’ve made significant changes to the business, these reports won’t be a true reflection on costs or sales. Since we know that many businesses have sadly had to make redundancies or change their costs significantly, the numbers in the reports will be very different.

If this is the case then you should take the reports potentially from 12 months ago or for the last 12 months and average those figures. You can then change the the totals that you know are no longer accurate and revise those based on what you will face going forwards.

The goal here is to make the figures that go into the Calculator as accurate as possible so that the figures that come out are also as accurate as possible.

In an earlier episode we discussed the importance of a cash flow forecast and for watching and monitoring your cash flow. If you have started this process it will help you check that your break even calculation is accurate.

If you still need to get your cash flow forecast in place you can find that module here.

As ever if you have any questions around this or any of the other rebound resources please do get in touch, we are very happy to help if we can.

Business News

We send regular updates that keep clients aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just add your details below and we’ll do the rest! We promise not to bombard you and you can unsubscribe at any time.