Monitoring your Cash Flow

There’s a very good reason why we made ‘Monitoring Your Cash Flow’ the first of our Rebound Resources! It’s absolutely paramount for any business coming out of the upheaval caused by the pandemic to be really aware of what their cash position looks like.

- You may have been closed, with no sales, for weeks at a time, on several occasions.

- You may have had overheads that you still needed to pay in that time, reducing any reserves to a minimal level.

- You may well be coming out of the pandemic with borrowings, either as a Bounce Back loan scheme or a CBILS loan, that you hadn’t even contemplated before.

- You may have had to refund deposits for events that couldn’t go ahead, or services you couldn’t supply during lockdown or due to staff shortages during the Omicron surge.

Any of these would put huge pressure on a business; any combination could be a dangerous one!

All of that said, if you have managed your cash carefully, with the injection of capital that may have come from the Government grants, the furlough scheme and any BBLS, CBILS or the Recovery Loan borrowings, you can start to look ahead and trade through.

To do so though, you MUST have good control of the business, and cash is key!

Cash is key!

This video summarises the content further down the page. We hope it’s helpful, whether you’re watching as we emerge from the pandemic restrictions or later. Monitoring the cash in your business will always be vital.

(Filmed during the first Lockdown, the content is still relevant to any business facing cash flow challenges.)

Your three options

We’ve got three different options for you to choose from when monitoring your cash, and in this section we’re going to outline each of them.

As with anything in business, there are pros and cons for each.

One will be the best option for your business; all you need to do is choose which, and make a start.

We’re here to help you or guide you in that decision making process and the implementation, so please do make sure that you incorporate one of them into your ‘new normal’ and the new habits we talked about in the earlier introduction video.

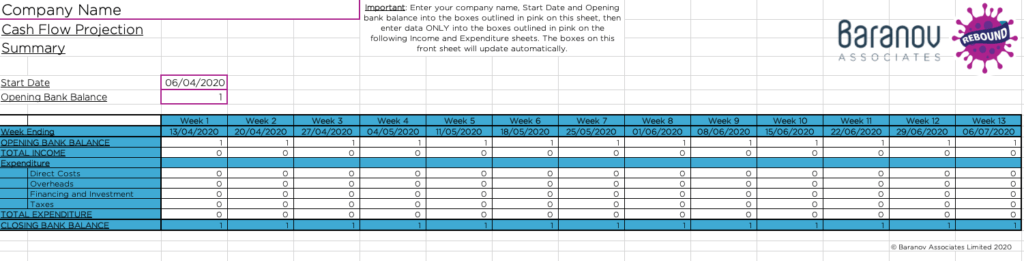

Option 1 – An Excel Spreadsheet

We’ve set up a template for you, including all of the necessary formulas, to make it as easy as possible.

- Entirely free, but will require time, discipline and accuracy.

- Quite considerable duplication of effort, as anything that goes into your bookkeeping software, also needs to be rekeyed onto the spreadsheet.

- Will give you a false position if it isn’t accurate!

- If you’d like to choose this option, you can download the spreadsheet here. Be sure to only key into the pink boxes, and start a new version regularly so you are consistently looking 90 days ahead.

Option 2 – Xero Analytics Plus

- A ‘bolt-on’ to your Xero system, Xero Analytics Plus is super-simple to set up and gives you a cashflow projection for up to 90 days.

- The basic Xero Analytics is included in your Xero Subscription but Plus give you more functionality but is extremely affordable.

- No duplication of effort between Excel and your bookkeeping system, reducing the risk of errors and requiring little extra time.

- Your bookkeeping needs to be kept reasonably up to date to get the best outputs.

- You can see more about Xero Analytics Plus here.

Option 3 – Float

A step beyond the functionality of Xero Analytics Plus, Float provides a cash flow forecast tool, and a host of other features.

- Float gives you the power to forecast your cash poison up to 3 years ahead.

- You can exclude or include bank accounts, and receive budget suggestions based on past data.

- Reports on budget vs actual figures and see what happens if invoices or bills aren’t paid.

- Scenario planning enables you to predict the effect of changes to your business before you gamble.

- This option has the highest subscription cost, but the benefits it can provide far outweigh the cost.

OK, I’m up and running, now what?

1. There is little value in getting your cash flow monitoring set up unless you use it.

Set up regular appointments in your diary to review the outputs. Cross check the output to your Budgets to see how you’re progressing; are you ahead or behind? Look ahead and see where your cash is going to be tight.

- Can you ease any outgoing payments to get you through a tight week or two?

- Can you bring forward any billing to get funds into your account sooner, to get you through?

- Do you need to look for external funding?

If you see a tight patch coming and aren’t sure what to do, give us a call!

2. Gather as much information as you can for the future.

This will enable you to look at as complete a picture as possible.

- Get an estimate into your cashflow for the Corporation Tax you may need to pay later in the year.

- Include any bills or payments you need to schedule.

Can my existing software do any of this?

Both Xero and Quickbooks have a cash flow function, but both are very limited in terms of their functionality. To be in proper control of your cashflow, you really need the enhanced level of accuracy and transparency that Xero Analytics, or ideally, Float can provide.

What else can I look at around my cash?

- We have a Guide to Controlling the Cash in Your Business that might be helpful. You can see a copy of that here.

- Your Cash Conversion Cycle is the time it takes for money to move through your business. It might be helpful to think about getting money in earlier, or holding on to it longer if you can!

- Review and refresh your Debt Collection Process to ensure your cash isn’t subsidising someone else’s business. We’ve mentioned before about new habits; now is the time to make sure you’re building good ones!

- Speak to us to discuss your current position and how we may be able to help you improve it.

Monitoring your cash is, as we’ve said above, vitally important. We’d recommend it to any business, in any environment, but in the current economy it’s absolutely essential.

If you’re unsure how to get started, please get in touch and we’ll very happily help you. The sooner you start, the more benefit you will get from the process, and the more comfortable you’ll be with the process once you’re back to running at full speed.

Business News

We send regular updates that keep clients aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just add your details below and we’ll do the rest! We promise not to bombard you and you can unsubscribe at any time.