Why do I need a Cash Flow Statement?

‘Why do I need a Cash Flow Statement?’ is a question we’ve been asked question several times in the last couple of days, after it was mentioned in a meeting with lots of business owners. We therefore thought it was worth explaining!

What is a Cash Flow Statement?

A Cash Flow Statement shows you how solvent your business is, and reports on the cash that comes from three types of activities: operating activities, investing activities, and financing activities. Whereas the other standard reports, the Income Statement and the Balance Sheet, take accruals into account, the cash flow statement is a true report of the cash in a business.

Regardless of the activity, there are two formats used for a cash flow statement; the Indirect and Direct methods. The difference is the inclusion in the Indirect method of depreciation, but both methods reach the same conclusion.

In summary, a cash flow statement will warn you if your sales aren’t making you enough cash to cover your bills over a given period of time, or to finance growth.

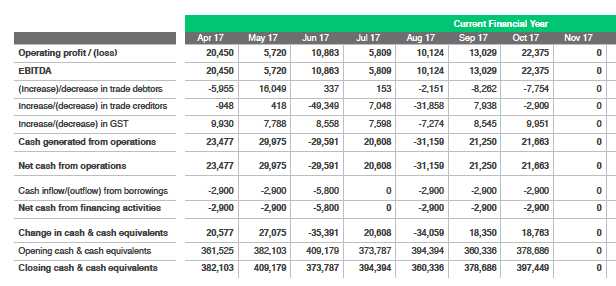

An example Cash Flow Statement is shown below:

What are the different activities?

- Operations – cash generated by day to day business activities, including sales, rent, materials and taxes. If the payment terms are too long on sales but short on purchases, businesses can experience painful cash shortages, despite a healthy order book.

- Investments – cash used to purchase assets, or the income from the sale of other businesses, equipment or previously held assets. Large figures here often reflect investment in advance of planned growth.

- Financing – cash paid or received from borrowing or loans, as well as share purchases or dividends.

What is the most important figure on the Statement?

This would be the net cash from operations. If this is negative, the business is using cash, and will need to borrow or look for additional investment to survive. A negative figure is an indicator that the business may well be in trouble.

A viable business needs to be generating enough cash from its operations to cover its costs, and on a regular basis if it’s going to make a profit!

What is EBITDA?

EBITDA is an acronym for the earnings before interest, tax, depreciation and amortisation. It can be used to analyze and compare profitability among companies and industries as it eliminates the effects of financing and accounting decisions. It’s intended to allow a comparison of profitability between different companies, but can be dangerous. EBITDA takes no account of the working capital needed in a business, which can be significant.

What are the other key items that could appear?

- Capital Expenditure – Money spent on long lasting items such as equipment, machinery etc. If these figure increases, it is likely to be because the business is growing. Without money to spend here, a business is restricted.

- Issue or Repayment of Debt – This indicates whether a business has borrowed or repaid money during the period.

How can I get a Cashflow Statement for my Business?

If you use Xero or Quickbooks, we can take care of this for you, and produce a monthly cash flow statement on your behalf as soon as your monthly bookkeeping has been completed. This can form part of a management information pack, or can be a standalone report; we can be as flexible as you’d like!

Why not ask us for more information now and get a clearer idea on how the cash is flowing through your business?