As businesses look towards the future, hopefully without pandemic restrictions, making the best use of Technology can be a really smart thing to do.

In this video we’re talking about the Apps that we use and recommend to clients. These can bring real benefits to your business:

- Save time in data input for you, your bookkeeper and the wider team.

- Improve accuracy and consistency of any input.

- Improve your cash-flow and forecasting.

- Improve your reporting and from there, the quality of your decision making.

…and more besides!

If you’ve got any questions around our choice of Apps once you have watched, do get in touch! Not all of them will be transformational for everyone, but some will; why not reap the benefits in your business now?

Before you dive in…

This video is a longer one than normal, so you might want to grab a cuppa before you hit play!

Do be sure to watch though, as there is content here that could help you make a BIG difference as you move forwards.

We’re huge advocates of technology if it’s used in the right place and in the right way. In this episode, I’m talking tech, and talking Apps in particular.

(Filmed during the first Lockdown, the content remains relevant to any business facing staffing challenges, economic uncertainty or who needs (or wants) to be as efficient as possible!)

The App Ecosystem

There are many Apps that bolt on to Xero and QuickBooks, and other accounting software, that can really help you move your business forwards, saving huge amounts of time and money. They can make a business far more efficient as well.

- They can reduce the time spent on manual input of data, which also then improves the consistency of that entry and reduces the amount of potential errors that may occur as the data is entered.

- They can dramatically improve your cash flow, which is obviously going to be a great thing right now.

- They can give you better information from which to make your decisions around the business.

- Using the right Apps, can improve the transparency within the business, so you can see how the business is working.

There are various Apps that we’ve spent a lot of time getting to know. We don’t make any commission or anything else for any of the Apps that we recommend. These are the Apps that we think will make the biggest difference to our clients and other small business owners.

We are partners to some of the App providers, but other times we’ll just recommend an App that we think would make a real difference to that particular business.

What I want to do here is take you through what we call our ‘App Stack’, which is just jargon for the different Apps that we think bolt together with either Xero or QuickBooks or whatever other accounting software, to give the business the best solution.

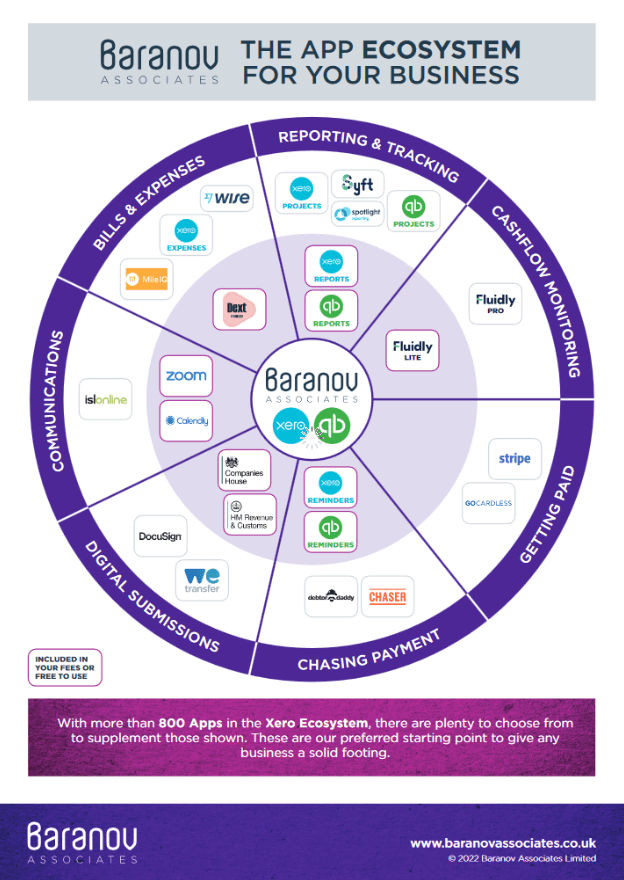

This is our App Stack diagram, and it looks pretty much like a trivial pursuit piece, really!

You can download a copy of the App Stack Diagram here: App Stack Diagram

(You can view or download a full size copy of this here.)

It covers various aspects of the business:

- Cash monitoring

- Getting paid

- Chasing payments

- Digital submissions

- Bills and expenses

- Reporting and tracking

All of the Apps on the inner circle are already included in the standard fees that clients pay. We cover the cost of those Apps because we think they are so beneficial. It’s like our fee protection scheme; we think everyone should have them.

(Please note that since this App Stack was created, Fluidly has taken the decision to withdraw from the market. We now advocate the use either of Xero Analytics Plus, or Float, which provide options that cover most businesses for their cash flow monitoring needs. Please follow the links to the Cash Flow Monitoring section below for more details, or get in touch.)

Segment 1 – Cash Flow Monitoring

We have an entire Rebound Resource devoted to this one, so do go back and have a look at it.

We’ve narrowed down the many available options to suggest two primary ones:

You can find out more about why we recommend both here.

Segment 2 – Getting Paid

Obviously, getting paid is paramount! The easiest way to make it more likely is to make getting paid as easy as possible. A BACS payment is something that a customer has to do directly to you, but there are other options.

Again, we have two options:

Stripe

For Credit or Debit card payments. It’s very, very easy to integrate with Xero and with QuickBooks, and with just a few clicks, and it means that your invoices will go out to your customers with a big blue button on them that allows them to pay the bill immediately.

- They can do that at a time that suits them.

- They don’t have to wait until you’re open to phone you with credit card details.

- You don’t have to have somebody phoning them to ask for that payment.

- When that payment goes through, it’s fully reconciled on your system, and any software you have chasing or sending reminders will automatically switch off.

- Stripe is very affordable too, so it ticks all of the boxes, hence, it’s on our App stack.

GoCardless

GoCardless is our preferred direct debit supplier.

It’s the one that we use ourselves.

If you can persuade your customers to go on to direct debit, and I think if you tried, it would be far easier than you think it might be. We were always reluctant to try and use direct debit for customers and for clients, but actually, it was easy and is now how we operate; we don’t have clients who aren’t on direct debit.

- GoCardless is very easy to integrate

- It’s great value.

- It’s easy for customers to set up. You send them a link to GoCardless on an email, and they just click on that link and fill in their details. You set them up in your bookkeeping system as a Direct Debit customer and the payment just automatically goes through.

- The biggest benefit is that it puts you in control of the payment process; you’re not having to wait for a client or a customer to make payment to you.

- From a customer perspective, they get the peace of mind of the fact that those payments are covered by the Direct Debit Guarantee. This means that if for any reason a payment should not have gone through, they can immediately contact their bank and get a refund.

Segment 3 – Chasing Payment

The last thing you want to be doing right now in your business is subsidising somebody else’s. It’s really important that we get paid for the services and the products that we’re providing and that needs to happen as quickly as possible. If you don’t get paid, there are some processes to follow. We’ll set-up a separate debt collection resource as a stand-alone because it is so important, but there are some Apps that can make the process easier.

Xero and Quickbooks reminders.

Both systems have their own internal reminder system. If you haven’t already done so log in, and for a really quick win turn those on. Your system will send regular reminders on any invoice that (your system thinks) hasn’t been paid.

This gives your customers the chance to raise a problem with the invoice, or ask for a copy etc. That will be much better than not having any chasing process set up.

There are two options that we prefer! Both take a lot of the stress and the pressure away from your debt chasing.

Debtor Daddy

This is the system we used in our original business. It worked really well. As soon as we implemented it, we saw an immediate improvement in our own cash flow.

It enables you to chase invoices by email on an automated, regular basis.

You can choose what tone of voice you want each customer to receive, from gentle to firm. You can therefore adjust the tone based on your experience of the customer and their payment profile. You can change the templates to use the language that’s in keeping with your business.

Chaser

Chaser is a far more sophisticated system, but which is still easy to set up and still affordable to use.

We’ve mentioned Chaser in the past; it can be really powerful if you have an issue with collecting and or chasing for outstanding debts. Chaser makes a lot of the chasing process automated, so they just happen and the earlier, younger debtors get taken care of. It’s only the older debts that become more of a manual process.

Whereas with Debtor Daddy you have the four voices and a set process, within Chaser, there is far more customisation possible, AND you have the opportunity to escalate.

You can set a point beyond which you can start sending emails to a sales director or other more senior member of the business. You can also have templates set up in Chaser, that they would be escalated from your end too, for example being sent from a Director rather than your bookkeeper.

If you are thinking about this as an option, please get in touch – we may be able to offer you a licence at a much reduced price!

When you think of what it would cost in terms of admin time, whether for you or for a member of your team, to have a majority of that automated and just happening in the background is a significant cost saving.

Segment 4 – Bills and Expenses

(We’re going to skip the Digital Submissions because you don’t have an option with those; they’re the ones you’ve got to use to do those!)

We’re going to split into two as a starting point.

Expenses

Xero has its own expenses functionality. This is available at a cost of £2.50+VAT per user per month, but it’s really worthwhile if your normal business model means that you’re traveling, paying for parking, buying coffee or lunch, and probably petrol.

Xero Expenses enables you to take a photo of the receipt, on your phone through the App. You complete a simple form on the App, and the expenses goes through to Xero.

- You can destroy the receipt, and know it’s recorded.

- You do not have to sit for several hours every month, or at the end of the quarter, or the end of the year to bring your expenses up to date.

You can give access to the App to your team, if they’re out and about too. Alternatively, if you’ve got somebody that goes out and buys milk for the office or similar, give them access, and they don’t have to worry about the receipt any longer. As long as they’ve got a photo of it, it’s taken care of.

Dext (Formerly known as ReceiptBank)

This is a significant step up from Xero Expenses because it does a huge amount more as well.

- It can do all of the expense functions, but also any covers any invoices that you receive, whether they come in by email or through the post. You can choose from multiple ways to upload those to Dext, and that information automatically feeds into your bookkeeping system.

- Dext also learns so if you have to code an invoice today, future invoices from that same supplier will be proposed to you to go to the same place. Again, it’s reducing any inconsistencies or data entry errors because it’s taking the information from the invoice and it’s putting it straight into your system.

- All of those times where you’re not sure where you coded that item the last time are overcome. You can then spend your time concentrating on other things within the business.

- If your bookkeeper is going to be using Dext, it frees up a significant amount of their time.

- It also frees up space because all of your invoices are kept electronically, so you no longer need to keep file copies or folders of invoices etc.

So there’re huge benefits to be had from using Dext. The clients who use it always respond along similar lines! We normally receive some variation on the following:

- ‘This is brilliant, why did I not do it before?’

- ‘I love Dext, it’s making my life so much easier. Why didn’t we do this earlier?’

As with the other Apps, Dext isn’t ideal for everybody, BUT those people that have tried it have never looked back and have just kicked themselves for not having done it before.

Segment 5 – Reporting and Tracking

Any reporting function is only going to be as good as the information you’re looking at, so to be effective will need your bookkeeping to be up to date. If it is, the right reports can be really helpful!

Both Xero and QuickBooks have their own reporting offer.

Xero’s reporting function is much better than QuickBooks, which is one of the reasons why we like Xero over QuickBooks.

Xero’s report suite has a new report format. If you’re already using Xero reports for things like your P&L, your Balance Sheet, and the various reports that are within the suite already, you may have some gaps that you’d like to fill. If so, do get in touch because the new report function may help that.

It’s not something that I can cover off in this video, but if you do have gaps, then do get in touch.

Spotlight Reporting – a step up beyond Xero and QuickBooks standard reporting suite, this allows you to see some of your reports graphically.

If you don’t look at a line of numbers or a table of numbers, like Chris does, and immediately see how things are moving, Spotlight might be the way to go for you.

If you’ve got budgets already in your system, you can see different lines on the graphs to see performance against budget.

You can see ratios.

Projects – These can be useful to track how particular projects within your business are developing. You can check, for example, whether your quotes are accurate.

There are limitations in this part of the system, but both QuickBooks and Xero are looking at this element and it is going to be improving. If it’s something you’re interested in, do get in touch and we can talk you through what’s going on.

That brings us to the end of the tour of our App Stack!

There’s a lot of information here and realistically, we could have easily done a video on each of these segments, if not each of these Apps.

The important point to make is that there are massive benefits to be had through the use of some of these Apps.

As we come out of lockdown, and as all of the the habits that we had going into the pandemic, are totally blown out of the water, now it’s time to think about setting new habits and new processes. The really good thing about using some of these Apps now is that you can embed them into your new processes, and get the benefits of them as you start to move forwards.

I’m pretty certain too, that setting these up is far, far quicker than you might anticipate!

If there’s any that you’d like to know more about, please do get in touch.

Business News

We send regular updates that keep clients aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just add your details below and we’ll do the rest! We promise not to bombard you and you can unsubscribe at any time.