We talked before about the paramount importance of tracking your cash flow, so our next priority is making the very most of the cash that we have!

A business that’s making profits can still go bust if they don’t monitor and protect their cash, so this isn’t something to ignore.

- How can you protect the cash in your business?

- How can you hold on to it for longer, get it in sooner, or even pay it out later?

Any one of the above will make a positive difference!

Many clients have taken out either BBLS, CBILs or Recovery loans, and have already pared back a lot of their spending, but there are other things to consider to make the very most of your cash.

Watch the summary here…

In this video we’ve got lots of ideas and suggestions for you to improve your cash position…

(Filmed during the first Lockdown, the content is still relevant to any business facing a crisis.)

Many clients have taken out either BBLS, CBILs or Recovery loans, and have already pared back a lot of their spending, but there are other things to consider to make the very most of your cash.

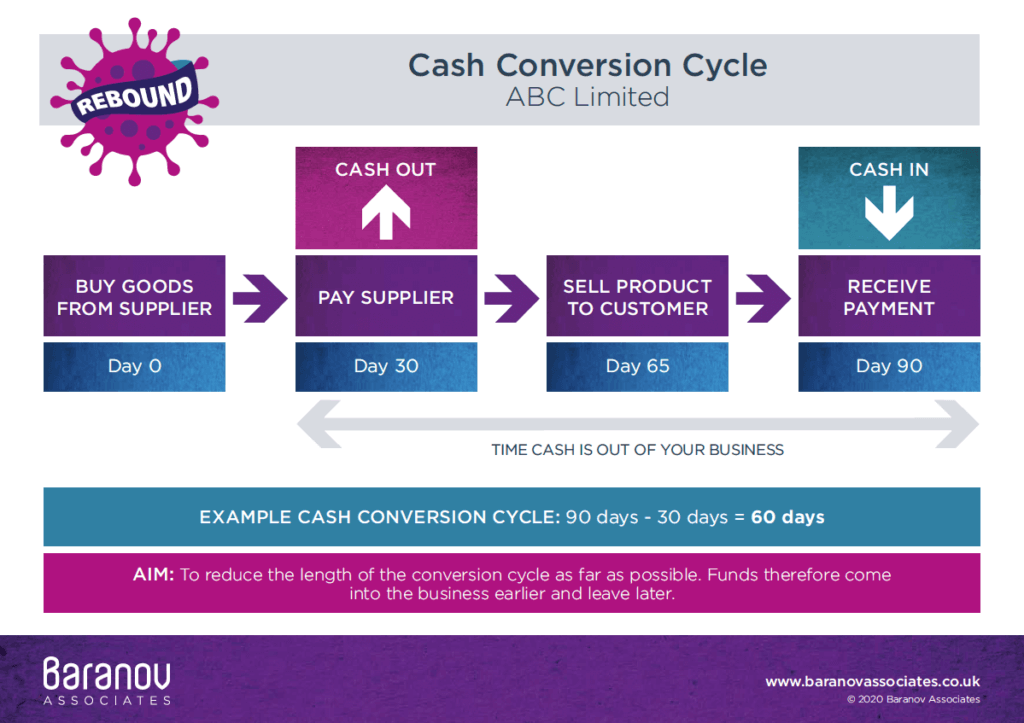

The graphic below is an example Cash Conversion Cycle for a product type business, as shown in the video above.

Step 1 – Review your own Cash Conversion Cycle

The goal is to reduce the time between you incurring costs, and getting payment from your customer.

This may differ across different product lines, or different services. If you have some areas of the business where the cycle is shorter, can you promote those areas? Can you apply the same approach to other areas of the business? Can you get funds in earlier in the cycle?

Can you get funds in earlier in the cycle?

1. Consider your terms and conditions.

Any changes that help get at least some funds into your business earlier than it arrives at the moment is a good thing. You don’t have to keep the same terms as you were operating with before Coronavirus hit!

Stage payments or deposits not only bring funds in earlier, but also give you leverage to receive that payment, or work stops.

Differentiate your payment terms. There is no rule that you have to have the same terms for all areas of your business. You could differentiate on types of customer, for example domestic or commercial. You could differentiate on the length of time you’ve known the customer. Do you trust them, based on previous performance, to make the promised payment?

For a new customer, shorter payment terms or deposits are a very sensible idea as we move into a more volatile economy.

2. Review your payment methods.

There are many different ways your customers can pay you. You are allowed to decide what your preferred method is and ask for that every time!

If you’d like to change your preferred method, perhaps to Direct Debit, start first with new customers. As business owners we often hold ourselves back as we think we know what our customers will, or won’t, like, but often we get a nice surprise!

You’re very likely to find much less resistance than you’re expecting.

Invoice Finance is worth considering if you work with bigger businesses with longer payment terms. It can often be worth the fee to gain the peace of mind of those funds hitting your bank account earlier. It’s also much more flexible than it used to be as a process, and is looked on more favourably too.

3. Review your Stock Levels.

Do you need to keep as much stock as you have previously? It’s one area where businesses tie up considerable amounts of cash. You only get the cash back once the goods are sold…

Step 2 – Look beyond the Cash Conversion Cycle

There may well be some strategic decisions that could make a BIG difference to your cash position.

1. Do you really need an office?

Many businesses were forced to make remote working possible over the last few months, and as a result they’re never going back! Productivity hasn’t been affected, staff are happier and costs could be reduced dramatically.

If you do still need a physical office, do you need one as large, or in the same area?

Rent can be a huge percentage of a businesses outgoings, so if it can be removed, or reduced, that has to be a positive. Of course there are other considerations, but it’s well worth some time to work through the thought process.

2. Staff

Salaries are another huge commitment for any business, but there are two primary considerations here.

- Can you improve retention, to avoid or reduce the costs associated with replacing leavers, both in recruitment or onboarding? Both are expensive processes.

- Do you need to streamline your team in light of the changing market? Now is the time to seriously consider whether you need to bring everyone back from furlough. It’s not a nice process, but the business is the priority.

3. Other aspects

- Can you outsource any of your functions?

- Can you improve your customer retention rate? It’s cheaper and easier to hang on to the customer who already know you and trust you than persuade strangers to spend with you.

- Can you cross-sell or up-sell to existing customers? As above, they already trust you. Increasing the value or frequency of any sale can make a big difference to your bottom line for much less effort. Do your existing customers know ALL that you can offer them? Have you reminded them lately?

- Can you convert more of your leads to sales? Losing prospects along the conversion process is a waste of your marketing efforts. Improve your conversion and you’re improving the return on the marketing investment.

- Review all of your supplier agreements and regular payments. Do you really need all of the subscriptions you’re paying for? Are you using all of the Apps you’re paying for? If not, and there’s no need for them, cancel them!

- Do you have Apps that you’re paying for that you know will make a difference, but you haven’t quite got around to implementing them? Now’s the time to get the benefit…

There are other areas to explore too, which we’ll cover separately, including Pricing and Debt Collection, but they’re too big to include here! The above will give you plenty to look at for now.

As ever, if you’re not sure how to apply any of the above to your business, please get in touch. We know that all of the above is very general, and very generic. There are very likely to be things that are specific to your business that will help you improve your cash position, and we’re very happy to help.

Business News

We send regular updates that keep clients aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just add your details below and we’ll do the rest! We promise not to bombard you and you can unsubscribe at any time.