Co-op Bank Bounce Back Loans – an update

On 28th May 2020, we published an update on Bounce Back loan lenders. In that update, we warned potential borrowers to be very careful of applying for Co-op Bank Bounce Back loans.

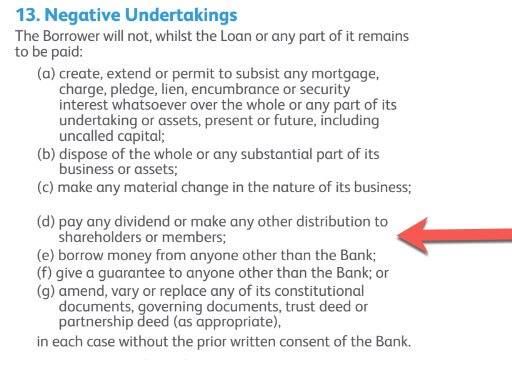

This was because their terms stated that you had to have written permission from them to take dividends while any amount of the loan was outstanding. This clause can be seen in the screen shot below:

Complaints were sent to the FSB, amongst other people, and now we have good news to share!

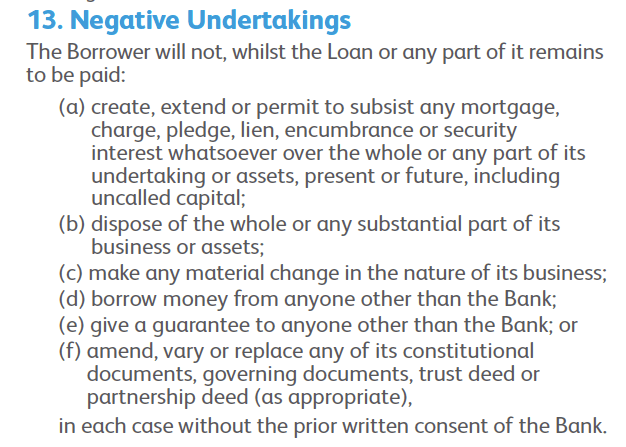

The new terms and conditions for the Co-op Bank Bounce Back Loans have been amended. The same clause now looks like this:

This is obviously good news, as the tax implications of the original clause would have been significant for directors who have previously taken a small salary and dividends. It’s reassuring to see that the Co-op have taken on board the objections that were made!

If you have an application pending with the Co-op Bank, please ensure you sign to accept these latest, amended terms.

If you’ve already taken out a BBLS with them, we would recommend questioning the clause; it may be possible that they will amend your terms, though there will be no obligation on them to do so.

Our recommendation would always be to scrutinise the terms of any agreement very carefully, regardless of how urgently you need that cash injection, or whatever solution is being offered. You need to be 100% sure that you aren’t solving one problem to create another!

Business Updates

We send regular updates that keep clients aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just add your details below and we’ll do the rest! We promise not to bombard you and you can unsubscribe at any time.