Which Business Banks offer the best service?

The Competition and Markets Authority (the CMA) requires an independent survey be carried out to ask customers of the largest Business Banks, providing current accounts in Great Britain and Northern Ireland whether they would recommend their provider to other small and medium sized businesses.

The survey ensures the sample of responses are representative of the Business Banks’ customer base, in terms of sector, region and turnover, with a target sample size of 1,800 customers per provider.

If you’re thinking of swapping your business bank, or are unhappy with yours for any reason, you may find the following useful in helping you decide where to start researching alternate providers.

This post is not intended to be any kind of recommendation, so please don’t take it as such. Ensure instead that you complete your own investigations before making any decisions. Your business is unique, and the most recommended provider in the categories below may not be the best one for you!

Which business banks are included?

In Great Britain:

Bank of Scotland, Barclays, Handelsbanken, HSBC UK, Lloyds Bank, Metro Bank, Monzo, NatWest, Royal Bank of Scotland, Santander, Starling Bank, The Co-operative Bank, Tide, TSB, Virgin Money.

In Northern Ireland:

AIB, Bank of Ireland, Danske Bank, Santander, Ulster Bank.

What questions are asked?

Customers are asked how likely they are to recommend their business bank provider for each of the following areas:

- Overall Service

- Relationship and Account Management

- Online and Mobile Banking

- Branch and Business Centre Services

- Overdraft and Loan Facilities

The survey is repeated every six months, and the last set of results, published last week, are now in!

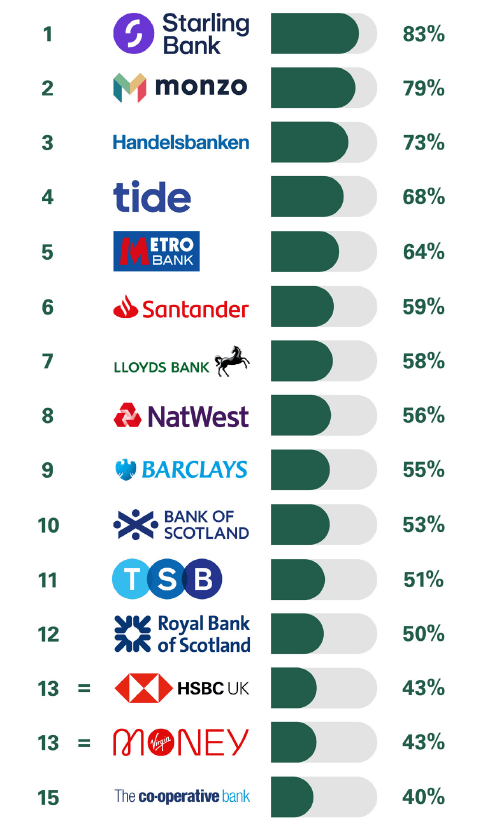

Overall service quality

Customers were asked how likely they would be to recommend their business current account provider to other SMEs.

Online and mobile banking services

Customers were asked how likely they would be to recommend their provider’s online and mobile banking services to other SMEs.

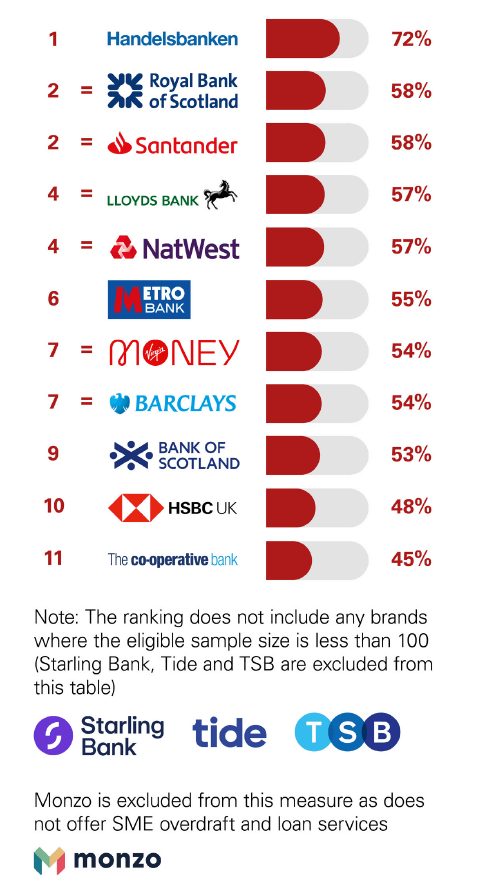

SME overdraft and loan services

Customers were asked how likely they would be to recommend their provider’s SME overdraft and loan services to other SMEs.

Relationship and account management

Customers were asked how likely they would be to recommend their provider’s relationship / account management to other SMEs.

Service in branches and business centres

Customers were asked how likely they would be to recommend their provider’s branch and business centres to other SMEs.

In summary…

As is so often the case, there are a range of winners across the different categories, but the overall result is that Starling has come out on top for overall service quality. This reflects the feedback that we’ve had about them over recent months, and our own findings as Starling customers.

Halifax and Barclays lead the way for the high street business banks, with Lloyds following close behind. Royal Bank of Scotland is in last place with less than half of customers surveyed likely to recommend them.

That said, as mentioned above, it’s important that you use a bank that suits the needs of your business, so perhaps service in a branch is important to you, or perhaps online services are more important. Either way, keeping an eye on these reports every six months may be beneficial.

These results are intended to encourage competition between providers, which the CMA hopes will ‘result in better experiences for all account holders’.

You can find more detail on the latest survey and previous results here.

Business News

We send regular updates that keep clients aware of changes and suggestions on a wide range of subjects; if you’d like to receive those too, just add your details below and we’ll do the rest! We promise not to bombard you and you can unsubscribe at any time.